Our Budgeting Methodology

Building financial confidence through structured guidance and real conversations about money. We focus on what actually works for Australian households.

Reality-Based Financial Planning

Most budgeting advice feels disconnected from daily life. Someone tells you to cut out coffee, track every cent, and suddenly you'll be wealthy. But that's not how people actually manage money.

Our approach starts with your current situation. Not where you think you should be, but where you are right now. We've spent years working with Australian families, and honestly, the patterns repeat. Income fluctuates. Unexpected expenses happen. Life gets messy.

So we built a system that acknowledges that messiness. It's structured enough to keep you on track but flexible enough to work when things don't go according to plan. Because they won't. And that's okay.

Three Phases That Build On Each Other

We break the learning into distinct stages. Each one prepares you for the next, and you won't move forward until you're ready.

Foundation Work

Understanding where your money goes right now. Not judging it, just seeing it clearly. We help you set up tracking systems that don't require perfection, just honesty. Most people discover they're doing better than they thought in some areas and worse in others.

Strategic Decisions

Once you know your patterns, we work on intentional choices. Where does money matter most to you? What expenses feel worth it versus what's just habit? This is where people start making changes that stick because they're based on personal values, not generic advice.

System Building

Creating structures that run on autopilot. Setting up accounts that serve specific purposes. Building buffer funds that absorb life's surprises. This phase transforms conscious effort into automatic progress, which is when real momentum starts.

Who Guides This Process

You'll work with people who've been in finance long enough to know what theory looks like when it hits reality. Our team combines formal training with practical experience from working directly with Australian households.

Each instructor brings different strengths. Some have corporate finance backgrounds, others started in community financial counselling. What they share is a commitment to teaching methods that work for regular people managing everyday money challenges.

We're not here to impress you with complicated strategies. We're here to help you build confidence with the fundamentals, because that's what actually makes a difference.

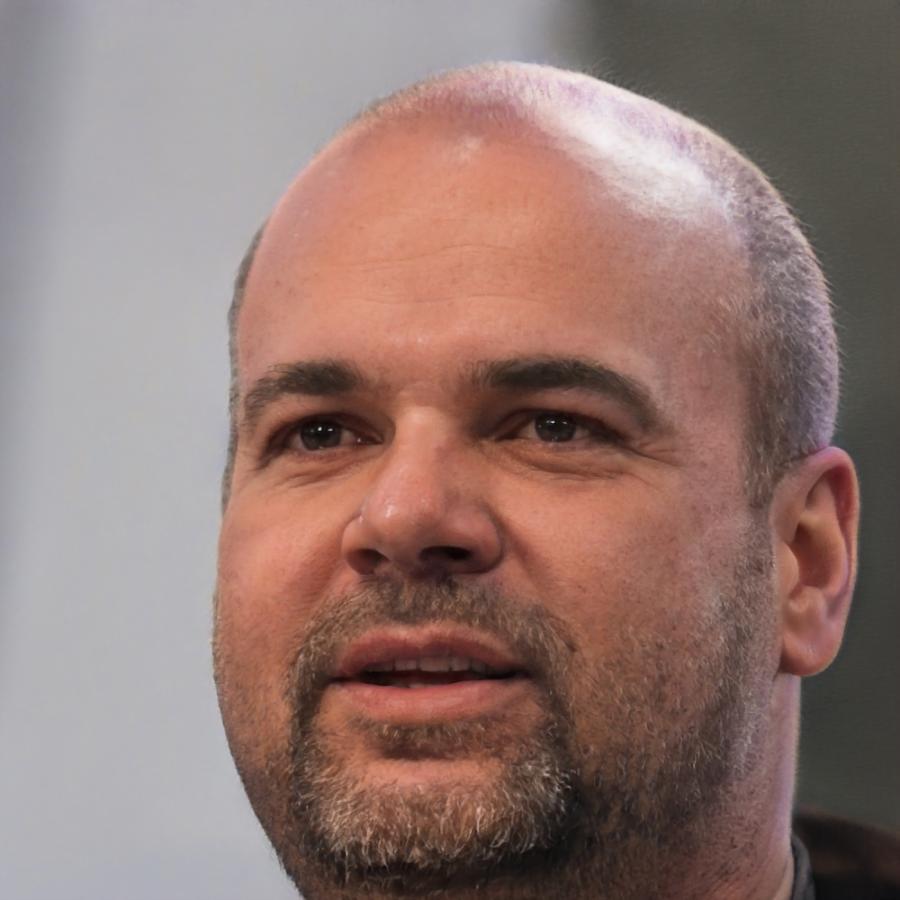

Rowan Thackwell

Budget Systems Specialist

Spent fifteen years helping families restructure debt and build sustainable spending plans. Focuses on the gap between what people intend to do with money and what actually happens.

Callum Burridge

Financial Behaviour Coach

Works on the psychology of money decisions. His sessions focus on why we make certain choices repeatedly, even when we know they don't serve us well. Practical, not preachy.

Pierce Linwood

Strategy Advisor

Background in financial planning for small business owners. Brings clarity to complex situations where income varies and expenses don't follow neat monthly patterns.

How You'll Actually Learn This

Step-by-step guidance that builds real capability, not just theoretical knowledge.

Document Your Current Reality

Before changing anything, you need to see what's actually happening. We provide templates and tools, but the work is yours to do. Three months of honest tracking gives you data that matters.

- Set up a simple tracking system that fits your life

- Identify patterns you hadn't noticed before

- Find the gaps between intention and behaviour

Design Your Framework

Using what you learned from tracking, we help you build a budget that reflects your priorities. This isn't about restriction. It's about making sure your spending aligns with what you actually value.

- Define non-negotiable expenses versus flexible spending

- Create buffer zones for irregular costs

- Build in realistic amounts for categories that matter to you

Test and Refine

Your first budget won't be perfect. Neither will your second. We teach you how to adjust based on what's working and what isn't. This phase is about developing judgment, not following rules.

- Review monthly to spot what needs changing

- Adjust categories based on real spending patterns

- Learn to distinguish between one-time issues and systemic problems

Automate What Works

Once you've found systems that fit, we help you set them up to run automatically. Direct debits, separate accounts, scheduled transfers—whatever removes daily decision-making and keeps things moving forward.

- Configure accounts to support your budget structure

- Set up automatic savings and bill payments

- Create backup plans for when automation fails

Ready to Start Building Better Systems?

Our next program begins in September 2025. Enrollment opens in July with limited spots available.

View Program Details